Following we provide information about our Impact Investment Strategy, referring to our definition of Impact, measurement methodologies and to the main aspects undertaken within the Sustainable Finance Disclosure Regulation 2019/2088 (“SFDR”), namely sustainability risks and principal adverse impacts (“PAI”) and how these aspects are taken into consideration within our investment process.

1. Impact Investing Strategy

Since its first investment vehicle, launched in 2006, Oltre has always been investing in companies with explicit and intentional potential to solve relevant social or environmental challenges.

1.1 Historical Background

From Oltre I onwards, the investment strategy has been one to focus on projects with an impact intention at the very core center of the business model, and not as a lateral feat. The intentionality is defined as the one to start from key social and human needs, rather than looking at commercial trends.

At the beginning, we have opened some markets, creating a track-record in those sectors with very high social impact traditionally excluded by the VC / PE industry, as social housing or accessibility of the healthcare system. In some cases, we have selected the most promising projects and brought them on the market, vesting them with solid business models capable of guaranteeing adequate financial returns. In this sense, we have always focused on the scalability of the business models either selecting the most scalable ones or working with our entrepreneurs to ensure solid growth: scalability is the key aspects to reach not only business appetite, but also a significant level of impact, namely when targeting a significant number of beneficiaries.

1.2 Our Approach

We invest in meaningful topics, namely targeting companies that can address social or environmental challenges of our society within a valid and scalable business model. As above mentioned, our target companies have an integrated model, in which Impact is pursued at the very center of the business activities and not as a lateral feat.

We think intentionality is a key aspect: while finance is progressively adding sustainability feats to traditional investments products, we have been having impact objectives at the core center of our financial activity from the very beginning. Pursuing impact with intentionality is profoundly different than the hype that sustainability is gathering recently. Indeed, elected companies have an intention to solve a relevant environmental or social challenge.

Having ensured the target companies we invest are impactful, then we commit to precisely measure the impact that they are able to generate, setting deal by deal Impact KPIs at the investment moment (see 1.5).

Despite we are sector agnostic, focusing on any company that can provide positive intentional scalable impact, we have identified three main goals that we want to target at a Fund level:

- Empowered People

- Healthier People

- Cleaner Planet

A quantitative target at an aggregated level will be dropped on these goals in the coming months.

To better explain the goals at a Fund level, we provide a synthetic and non-exhaustive clarification of the sectors that can fall under them.

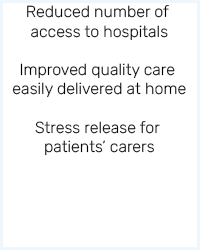

Healthier people: under this goal we comprehend all those sectors that can help people to improve their health and well-being conditions: healthcare, accessibility of the healthcare system, personal care and well-being, home care, social assistance to elderly.

Empowered people: we aim to invest in companies that can help individuals to live in safe, fair, diverse and without risk of exclusion. Under this goal we include sectors as education and employment, local development, social tourism, safety in work places, activity in underserved areas.

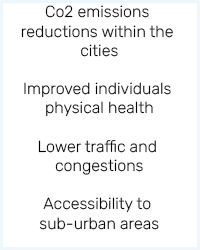

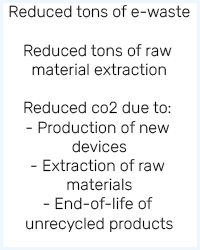

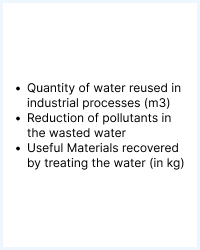

Cleaner Planet: all the solutions that can contribute to the ecological transition and to fight climate change are broadly comprehended under this broad goal. Some examples of sectors we have invested in, or aim to invest in the future: green energy, smart cities & green mobility, food & agriculture, waste savings, sustainable construction, clean air and water, sustainable goods and services in general.

In addition to the fact that our investments have intentionality in pursuing a social or environmental goal, we screen the sustainability risks and assess ex-ante our investments according to the PAIs we consider relevant, as will be explained later.

1.3 Impact Framework

To provide a thorough assessment of our portfolio we have designed a map that can help us in organizing our portfolio across our impact goals identified at a fund level and across the SDGs. Indeed, along the investment process we make sure that each of our investments can fall under the scope of our impact goals and being at the same time aligned with the SDGs.